We are breaking up/divorcing. And we are figuring out who's going to have custody of the kids, who's going to see them and how often, and how much is the child support. Child support, and the obligation to pay it, are a frequent cause of disputes between former spouses. How to correctly determine the amount?

In the end of 2022, the Czech Ministry of Justice published new recommendatory material for setting child support for children who are not being raised jointly by their parents. It is a more sophisticated replacement for the simpler 2010 table. Although it is only a recommendation, in practice it is relied upon by courts and parents in out-of-court agreements.

In general, the parent has a maintenance obligation towards a child who is unable to support himself/herself. The parent who is obliged to pay maintenance is hereinafter referred to as the "obligor parent". But how to determine the amount of maintenance? The basic considerations for determining the amount of maintenance are:

- standard of living of children should be essentially the same as that of their parents;

- the child's reasonable needs.

The first aspect precedes the second (it is more important).

However, the Ministry's table does not take into account many parametric circumstances that occur regularly, as well as specific circumstances that may arise in particular cases. As for the common circumstances that the table does not take into account, these include, for example, the overall financial circumstances of the obligor parent, the child's place of residence, and the earning potential of adult children in education. As regards specific circumstances, the table does not take into account the increased costs of children with special needs (e.g. disabled children); the situation where the obligor parent forgoes better earnings without a serious reason; the higher number of maintenance obligations (the table assumes a maximum of 4 children); obligor parents with highly above-standard incomes.

How to determine child support?

Child support is based on the net income of the obligor parent

Maintenance is calculated on net income. In the case of employees, income is "netted" of personal income tax, social security and health insurance contributions, but overtime pay, bonuses, gratuities, etc. are not deducted. In the case of entrepreneurs, the tax return is used to determine at least an indicative average monthly net income. The court will usually ask the parents for their pay slips for the last 12 months or the tax return for the last tax year. Income will also include welfare or other state benefits received, the parent's rental income, and various other income.

Life stage of the child is important

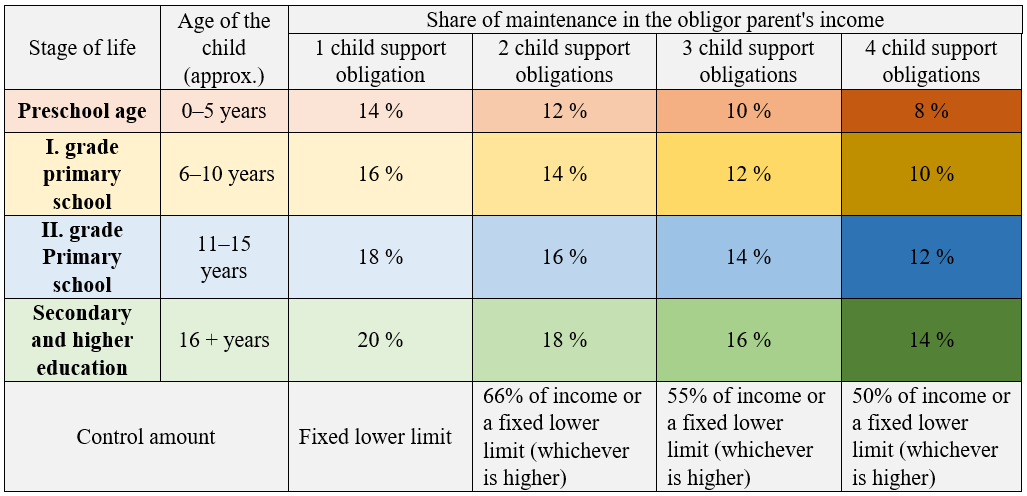

The table is divided into 4 stages of a child's life, namely Pre-school age (0-5 years); Primary I (6-10 years); Primary II (11-15 years); Secondary and higher education (16 years and above). The age ranges are indicative only. In fact, the level of education is a truer indicator of a child's needs.

The number of maintenance obligations of the obligor parent is taken into account

If the obligor parent has more than one child to whom he/she has a maintenance obligation, the table takes this into account. Different percentages are set for each life stage of the child, depending on how many maintenance obligations the parent has. Thus, a two-year-old only child would be entitled to maintenance at 14% of the obligor parent's income, but if he had three other young siblings, it would be 8%.

The amount of care and contact with the child is also taken into account

In practice, it is often the case that the obligor parent provides for many of the child's ordinary needs - paying for the child's lunches in kindergarten, buying him or her clothes and paying for hobbies, and spending a lot of time with the child (even thoughthis parent does not have custody). Should he or she still pay the same child support as if he or she had not provided all this? The guidance material now takes these cases into account. It uses the aspect of the number of days per month that the child spends with the obligor parent. In particular, full days (with overnight stays) are counted.

- (Number of days per month with the obligor parent) / 30.4 = care ratio

- (1 - (care ratio)) * (provisional maintenance amount) = maintenance amount depending on care

However, if the number of days does not correspond to the extent to which the obligor parent contributes to the child's normal needs, the court will instead assess the situation individually.

Control amount

If the amount of child support (or the sum of the amounts for all children) is too high compared to the standard of living of the obligor parent, the child support may be adjusted. Therefore, a limit is set for the amount that the obligor parent should be left with. There are two ways of calculating this, and if the amounts are different, the higher amount is used.

The first method of calculation is a % of income according to the number of maintenance obligations (e.g. for 2 maintenance obligations it is 66% of income). The second method is a fixed lower limit, determined in the same way as the "non-forfeitable amount" when calculating deductions from the debtor's income in execution and debt settlement, and can be determined using the Instalment Calculator for debt settlement. In the box next to the number of children, "0" is selected, "no" is selected in the "spouse" box, and only the net wages are entered. The "wages to be paid" amount is the control amount.

The control amount is deducted from the net income and the result is the indicative maximum maintenance amount. If the calculated amount of maintenance for one child would 'interfere' with the control amount, it is reduced so that the obligor parent is left with the control amount. In the case of multiple maintenance obligations, a calculation is used which reduces the individual maintenance amounts proportionately. The support calculator on the Ministry of Justice website can be used with some caveats. However, the amount does not take into account the many specifics that a court may take into account when determining child support.

How about child support increases?

Child support is increased if the child "moves on" to the next life stage according to the table. At the same time, if more than 3 years have elapsed since the previous maintenance determination but the child remains in the same life stage, it is appropriate to increase the maintenance by 1% of the share of the obligor parent's income.

What about obligor parents with highly above-standard incomes?

There may not always be a direct proportion between the obligor parent's income and the amount of child support. According to the Constitutional Court, a disproportionately high maintenance which enables the child to lead a long-term/permanent work-free life even after the child has completed his or her vocational training may be contrary to the best interests of the child. Setting such high maintenance may also violate the right of a parent to bring up his or her child. Thus, the fact that the obliged parent is objectively able to pay a certain amount of child support to the child does not mean that he or she should receive it without further debate.

Do you always have to pay child support only in money to the other parent or to the child?

Not always. The obligor parent may provide part of the maintenance, for example, in the form of a contribution to the child's building or other savings, or purchase certain goods or services directly for the child.

Why do parents sometimes send money to each other's accounts? Can't child support claims be offset?

In practice, situations sometimes arise where parents send child support to each other. This situation arises in particular if the court decides on alternate custody. Each parent then takes turns caring for the child and also has a court-ordered obligation to contribute to the maintenance of the child, usually at the hands (to the bank account) of the other parent.

Why the court doesn't stipulate that only one parent will send child support, and only the difference between the child support amounts? The answer is that the law (currently) prohibits offsetting a child support claim for a minor who does not have full legal capacity. The claim belongs to the child ("it is the child's money"), which is why the parents cannot offset it between themselves. Therefore, the court cannot order a "set-off" of child support claims. The advantage of such a ruling may be if one parent stops paying child support.

The obligated parent can be ordered to pay child support in the monthly amount set in the judgment (we wrote about what to do if a parent violates the obligations set in the judgment regulating the child's circumstances here). However, if the parents agree on the amount of child support, only the "difference" can actually be sent.

If you are dealing with the other parent of your child regarding child support, we recommend that you consult with an experienced attorney beforehand.